It is going to help me in more ways then one. Not only will I keep more of my own money, but it helps the company I work for. Had a 1 hour call yesterday. We were getting a new building on 5 acres "Only happened after the election". Now they are going to let me get 10 acres and spend another 5 million on equipment for 2018. We are also going to hire a few more people.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

https://okpolicy.org/oklahomans-fare-congressional-gop-tax-plan/

How Oklahomans would fare under the Congressional GOP tax plan

by Gene Perry | November 9th, 2017 | Posted in Taxes |Comments (4)

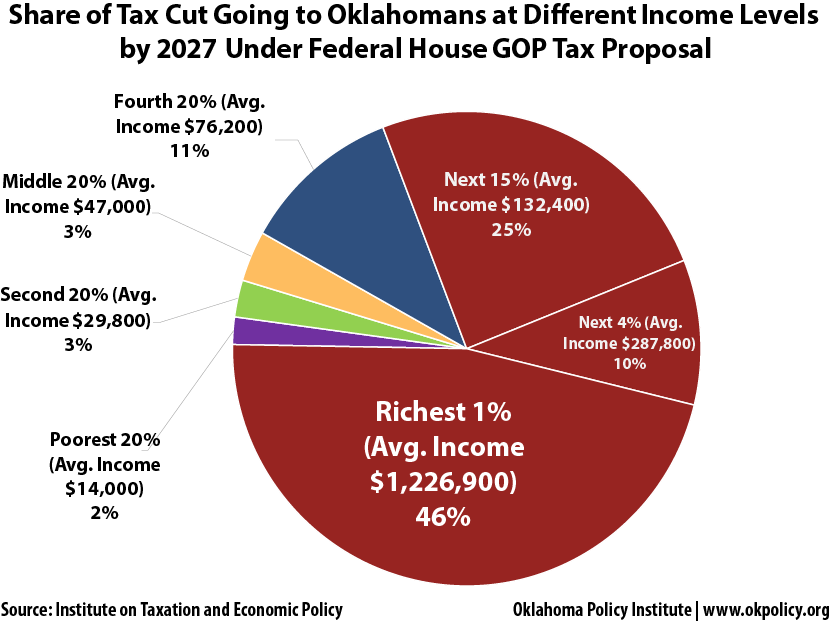

A new analysis of the Congressional GOP tax plan reveals that in Oklahoma, the wealthiest 1 percent will receive the greatest share of the total tax cut in year one, and their share would grow through 2027. The value of the tax cut would decline over time for every income group in Oklahoma except the very richest.

Republican Congress members are trying to sell this tax proposal, which will increase the federal deficit by $1.5 trillion over the next decade, as a plan to boost the middle class. But a closer examination of the bill’s provisions reveals that it is laser-focused on tax cuts for the nation’s highest earning households. The wealthiest Oklahomans’ share of the tax cuts would grow over time due to phase-ins of tax cuts that mostly benefit the rich and the eventual elimination or erosion of provisions that benefit low-and middle-income taxpayers.

For example, after five years, the bill eliminates a pair of $300 tax credits that benefit low- and middle-income families while fully repealing the tax on multi-million dollar inheritances in year six. This bait-and-switch appears to be designed to make average Oklahomans and Americans think the tax plan was designed for them, when in fact it phases out their benefits to replace them with more tax cuts for the extremely wealthy. The Institute on Taxation and Economic Policy did a 50-state analysis of who receives the benefits after all elements of this plan are phased in. Here’s what they found for Oklahoma:

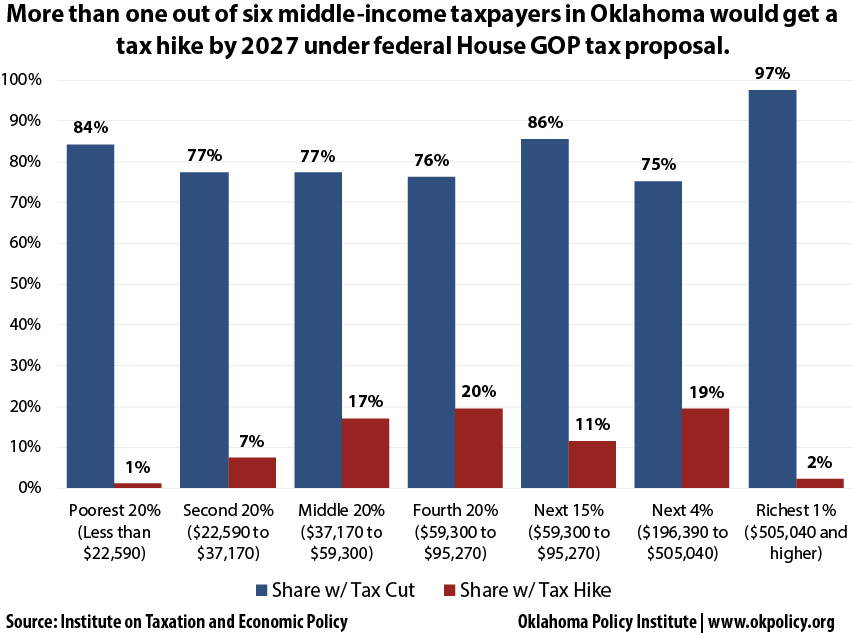

The wealthiest 1 percent of Oklahoma households would see their share of the tax cut increase from 30 percent in year one to 46 percent by 2027, for an average cut of $47,950. Over those same years, middle-income taxpayers’ average tax cut would erode from $540 to $170. By 2027, more than one in six middle-income Oklahoma households (17 percent) would actually see a tax increase under the House GOP plan.

Even as this bill raises taxes on some some low- and middle-income families and provides no benefit to many others, it would add $1.5 trillion to the deficit. That could mean deep cuts down the line to important services for poor and middle-class Oklahoma families. Some House Republicans have already made clear they intend to try to pay for these tax cuts next year by cutting programs like nutrition assistance, Medicaid, and college aid that help families make ends meet.

The $1.5 trillion cost of this plan could be used in many ways that are more effective at boosting the economy and the well-being of Oklahomans and Americans. To put that number in context, $1.5 trillion – or $150 billion per year – would roughly equal ALL of the following:

Under the tax cut plan, we could do none of these things; we are more likely to instead see cuts to these programs. And because Congressional Republican proposals to cut federal spending almost always involve shifting costs down to state and local governments, the tax bill will put even more pressure on Oklahoma’s budget. It should be clear to anyone who’s paying attention that Oklahoma cannot afford even more pressure on the state budget right now.

- Doubling the Pell Grant program, which provides aid to low- and moderate-income college students; AND

- Doubling cancer research at the National Institutes of Health; AND

- Funding the full backlog of needed maintenance at National Parks; AND

- Providing child care assistance to 6 million children; AND

- Providing opioid addiction treatment to 300,000 people; AND

- Training 3.5 million workers for in-demand jobs.

Oklahomans deserve a tax plan that focuses its benefits on working families who have been hit hardest by the stagnant incomes and rising inequality of recent decades — not one that gives most of the gains to those who are already taking most of the income growth. Oklahomans and all Americans deserve a plan that invests in education, health care, infrastructure, and other building blocks of strong families and a strong economy. The Congressional GOP tax bill does the opposite.

See that Red part of the pie?

That's the part that trickles down to the rest of us.

When if finishes trickling down we will have ALL the money.

Doing what?We are also going to hire a few more people.

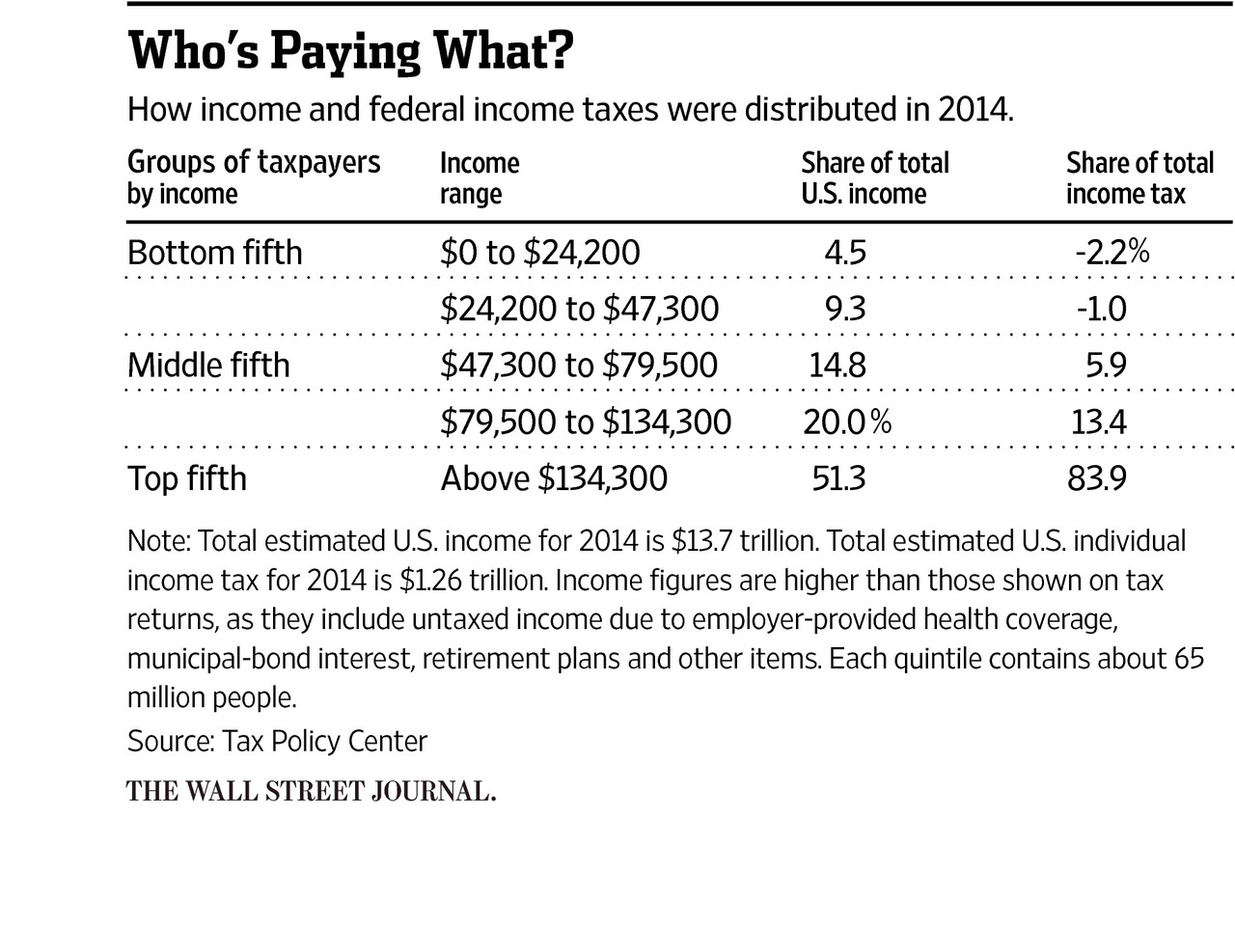

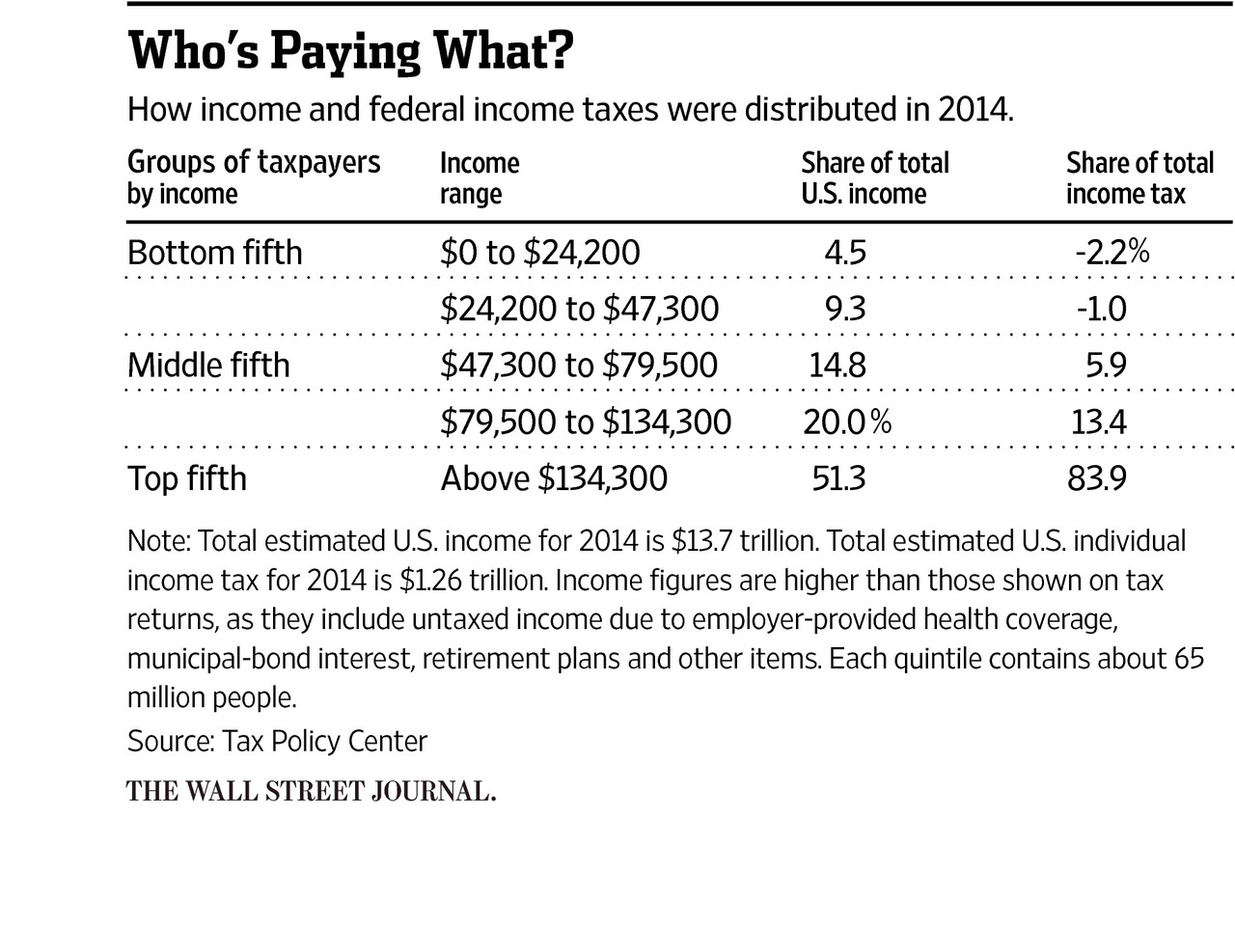

Kind of nice that even people who don't pay taxes are getting some benefit from this, 2 or 3 pct takes them even further left from zero. And this is some how a national tragedy?

https://www.wsj.com/articles/top-20-of-earners-pay-84-of-income-tax-1428674384

https://www.wsj.com/articles/top-20-of-earners-pay-84-of-income-tax-1428674384

We do cooling towers. We work nation wide, mostly in power plants.Doing what?

It is going to help me in more ways then one. Not only will I keep more of my own money, but it helps the company I work for. Had a 1 hour call yesterday. We were getting a new building on 5 acres "Only happened after the election". Now they are going to let me get 10 acres and spend another 5 million on equipment for 2018. We are also going to hire a few more people.

Not sure if what's left of the cheap seats around here will be able to handle real world examples such as this.

http://fox4kc.com/2017/12/20/hundreds-of-metro-att-employees-laid-off-just-before-christmas/But AT&T is going to give a 1 time $1000 bonus to lots of poor people. They will be well off then! LMAO.

“How can you lay people off and then give them $1,000 and say that there’s going to be more jobs available? “

oops, there goes the tax cut holiday cheerhttp://fox4kc.com/2017/12/20/hundreds-of-metro-att-employees-laid-off-just-before-christmas/

“How can you lay people off and then give them $1,000 and say that there’s going to be more jobs available? “

At this point, I'm so disenchanted with the lot of them I couldn't care less about which party is in office and how they decide to flush our government down the toilet. I'm certainly not a fan of the man we elected. That said...

Quick pencil work shows this plan will save a few thousand in taxes every year, so I'm happy there. I've reach the full homo economicus stage in my life and would rather keep that than see it taken before I have a chance on where to spend/save/charity the money.

Quick pencil work shows this plan will save a few thousand in taxes every year, so I'm happy there. I've reach the full homo economicus stage in my life and would rather keep that than see it taken before I have a chance on where to spend/save/charity the money.

Similar threads

- Replies

- 49

- Views

- 4K

- Replies

- 63

- Views

- 7K

- Replies

- 71

- Views

- 8K

- Replies

- 7

- Views

- 1K

Join the conversation!

Join today and get all the highlights of this community direct to your inbox. It's FREE!

- Curated content sent daily, so you get what's interesting to you!

- No ads, no large blocks of text, just highlights for easy digest

- It's all totally free!

Enter your email address to join:

Thank you for joining!

Already

a member? Click here to log in