You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

Well it's a VISA and I can choose to use credit when paying, although not sure how that works cause it still take the money from my account same a a debt transaction?

VISA just processes and guarantees the payment.

Well a smart man would pay cash for it. Since I have no more debt, I pay myself $2000 a month (that used to be payments) to put into mutual funds. Thats $24k a year cash plus 12% growth. If I need $20k tomorrow, I have it there.

Plus I keep $10k setting in savings for an unexpected emergency (insurance).

A really smart man would have credit cards that pay cash back. For instance, Discover Pays 5% cash back Jan-Mar for Gas and Apr-Jun for Groceries. Both are necessities you can easily pay cash for, but why pass up the free money and credit history?

Because thats a marketing strategy. It's proven (they say) that this exact scenario will cause a person to spend an average of 18% more than if they were seeing that Benjamin leave the palm of your hand.A really smart man would have credit cards that pay cash back. For instance, Discover Pays 5% cash back Jan-Mar for Gas and Apr-Jun for Groceries. Both are necessities you can easily pay cash for, but why pass up the free money and credit history?

CC companies are tricky rich basturds

My visa/debt is on my report.Debit cards do not show up on credit reports as there is no open line of credit attached.

My visa/debt is on my report.

Then it has an open revolving credit account tied to it. Otherwise you're not borrowing anything, it's your money in your banking account.

I've no idea, that's why I asked.Then it has an open revolving credit account tied to it. Otherwise you're not borrowing anything, it's your money in your banking account.

From CreditKarma:

How to Understand Credit Scores

Your credit score is a three-digit number that relates to how likely you are to repay debt. Banks and lenders use it to decide whether they’ll approve you for a credit card or loan. But did you know you actually have more than one credit score?

How credit scores are created

The three main credit bureaus – Equifax, Experian and TransUnion – create your credit reports, which credit scoring models like VantageScore and FICO use to come up with a score that typically ranges from 300-850. The credit bureaus can also calculate scores for you based on their own proprietary models.

Your scores are typically based on things like how often you make payments on time and how many accounts you have in good standing.

Your score will never factor in personal information like your race, gender, religion, marital status or national origin.

Why you could have different scores

With so many ways to calculate credit scores, it’s not uncommon to have multiple different scores at the same time.

You could have different scores if a lender doesn’t report to all three credit bureaus or reports updates to them at different times. Some lenders may only report to one or two bureaus (or none at all).

You could also have different scores depending on the lending situation. For example, an auto lender might use one scoring model, while a mortgage lender uses another.

Scoring models – what’s the difference?

Equifax, Experian and TransUnion collaborated to create VantageScore to offer more scoring consistency among the bureaus.

VantageScore boasts that its 3.0 model can score millions more people than other models by incorporating up to 24 months of past credit activity – including utility and rent payments where available – which could open up more credit options to you.

VantageScore has three scoring models and FICO has many more, but they all generally consider similar factors to calculate your scores, such as:

How to Understand Credit Scores

Your credit score is a three-digit number that relates to how likely you are to repay debt. Banks and lenders use it to decide whether they’ll approve you for a credit card or loan. But did you know you actually have more than one credit score?

How credit scores are created

The three main credit bureaus – Equifax, Experian and TransUnion – create your credit reports, which credit scoring models like VantageScore and FICO use to come up with a score that typically ranges from 300-850. The credit bureaus can also calculate scores for you based on their own proprietary models.

Your scores are typically based on things like how often you make payments on time and how many accounts you have in good standing.

Your score will never factor in personal information like your race, gender, religion, marital status or national origin.

Why you could have different scores

With so many ways to calculate credit scores, it’s not uncommon to have multiple different scores at the same time.

You could have different scores if a lender doesn’t report to all three credit bureaus or reports updates to them at different times. Some lenders may only report to one or two bureaus (or none at all).

You could also have different scores depending on the lending situation. For example, an auto lender might use one scoring model, while a mortgage lender uses another.

Scoring models – what’s the difference?

Equifax, Experian and TransUnion collaborated to create VantageScore to offer more scoring consistency among the bureaus.

VantageScore boasts that its 3.0 model can score millions more people than other models by incorporating up to 24 months of past credit activity – including utility and rent payments where available – which could open up more credit options to you.

VantageScore has three scoring models and FICO has many more, but they all generally consider similar factors to calculate your scores, such as:

- Your payment history

- How long you’ve had credit

- The types of credit you have (credit cards, auto loans, student loans, mortgages, etc.)

- Your credit limits and how much of those limits you’re using

- How much debt you have

- Hard inquiries on your credit report

We are a one income family and I make the money.

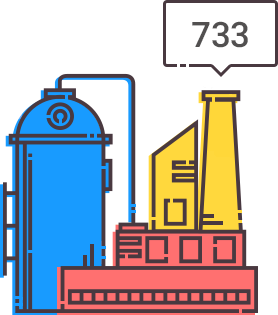

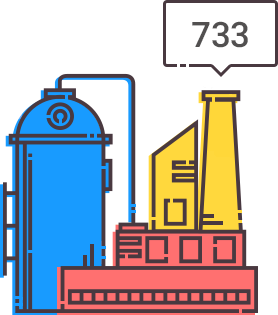

Here are my scores from creditkarma:

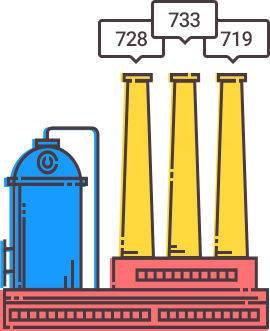

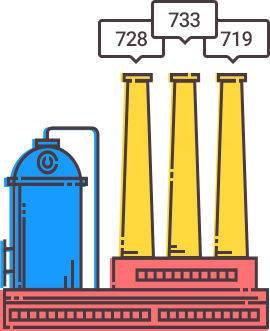

And here are my non-income earning spouse:

Kind of goes against common sense and logic doesn't it? I mean my wife doesn't have an income and has a higher score...

Here are my scores from creditkarma:

And here are my non-income earning spouse:

Kind of goes against common sense and logic doesn't it? I mean my wife doesn't have an income and has a higher score...

I was in the same boat a few years back. I've paid for my houses, vehicles, and land all with cash. I owed nobody anything and had no "bills" other than the monthly utility stuff. Then, 100 acres of land that adjoins ours came up for sale pretty quick. I had good money in the bank..but zero credit. Going to the bank and offering them $20K cash down payment wasn't enough. I didn't get that land. I decided that as much as it pained me, I needed to get some kinda credit established. I went and got a few credit cards and we purchased another vehicle on credit, then another house and property. Credit is pretty darned good right now. I do have bills, but they aren't anything that I can't handle; even if I lost my job tomorrow we'd still have a place to live.

I think the trick is to not overextend yourself with credit. Get a credit card and use it once or twice a month at the gas pumps and your credit will build up. If you decide to get a Lowe's credit card, pay it off every month or at least as soon as you can. If you buy a $200 gadget from Lowe's on your card and pay $10 on it, they will continue charging you the interest for the full $200 until you get it paid off. It's a racket and a lot of credit card companies do that from what I've heard.

I think the trick is to not overextend yourself with credit. Get a credit card and use it once or twice a month at the gas pumps and your credit will build up. If you decide to get a Lowe's credit card, pay it off every month or at least as soon as you can. If you buy a $200 gadget from Lowe's on your card and pay $10 on it, they will continue charging you the interest for the full $200 until you get it paid off. It's a racket and a lot of credit card companies do that from what I've heard.

Last edited:

Similar threads

- Replies

- 68

- Views

- 3K

- Replies

- 49

- Views

- 4K

- Replies

- 0

- Views

- 375

Join the conversation!

Join today and get all the highlights of this community direct to your inbox. It's FREE!

- Curated content sent daily, so you get what's interesting to you!

- No ads, no large blocks of text, just highlights for easy digest

- It's all totally free!

Enter your email address to join:

Thank you for joining!

Already

a member? Click here to log in